Chargebacks

Form:

CSU Chargebacks Template![]()

Last Revision Date: 09/2019

Macro Enabled: Yes

Form: New Service Provider![]()

![]()

Last Revision Date: 03/2013

Macro- Enabled: No

Need Help?

Chargeback User Guide for MP 4.0![]()

![]() (eff 11/16/2020, see Steps 66 to 70)

(eff 11/16/2020, see Steps 66 to 70)

Requesting Access to the Z Drive![]()

![]()

Requesting Access to CFS Finance![]()

![]()

Service Provider List![]()

![]() (updated 11/14/2024)

(updated 11/14/2024)

Department-Fund Combo Edits ![]() (updated 07/24/2024)

(updated 07/24/2024)

To access the Z drive when working remotely, use rollout laptop and make sure the Global Protect VPN is connected (csufvpn.fullerton.edu).

Definition:

Service Providers provide goods and services to other campus units for reasons of cost advantage and convenience.

A chargeback is an expenditure made by California State University, Fullerton for or on behalf of another University department/unit. Chargeback activities are also known by the campus community as “recharges”.

Accounting Services & Financial Reporting oversees the chargeback process. For questions regarding chargeback transactions billed to your department, contact the Service Provider using the Service Provider List![]()

![]() .

.

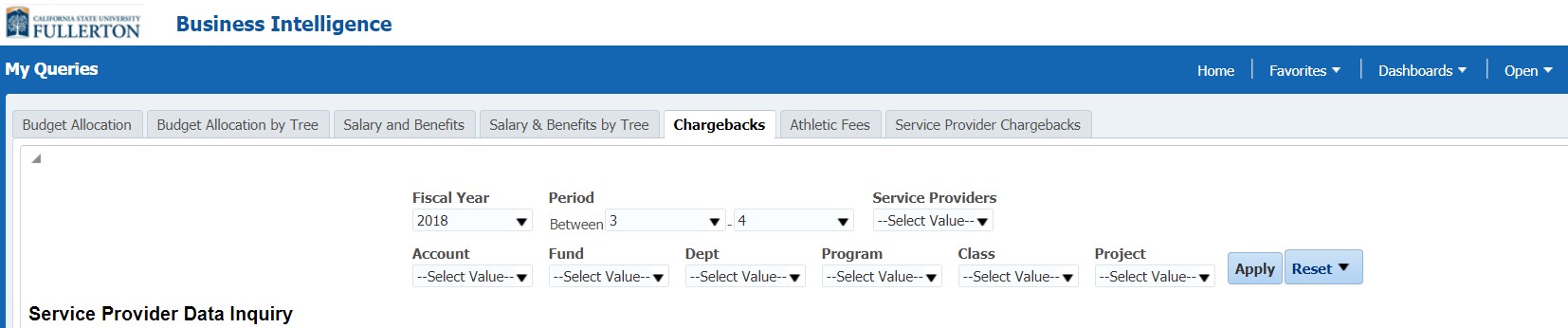

Chargeback transactions can be accessed in the Campus Portal under:

Titan Online > Business Intelligence > OBIEE 12c – BI/Dashboards > My Queries > Chargebacks

For Service Providers:

Fund Management

Service Providers who manage the chargeback process operate in fund THEFD (CSU fund 485). All costs/expenses associated with running the chargeback center must be paid out of THEFD. Revenue billed in THEFD cannot be moved out of THEFD. After all costs/expenses related to the chargebacks are transferred to fund THEFD, revenue surplus must be explained. In general, THEFD accounts for Service Provider departments should have a minimal balance at fiscal year-end. A mark-up or admin fee should only be charged for a specific reason such as asset replacement. Mark-Up Policy is subject to review and approval by Accounting Services & Financial Reporting and the Controller's Office. Excess revenue surplus at fiscal year-end (06/30) will be carried forward to the new fiscal year (07/01) thru a Budget Transfer journal.

Billing Disputes

In the event that CSUF Auxiliary Organization disputes an invoice, a credit invoice will be processed. Service Provider must provide a new department to be charged. If not provided, the Service Provider's department will be charged.